25+ what is dti for mortgage

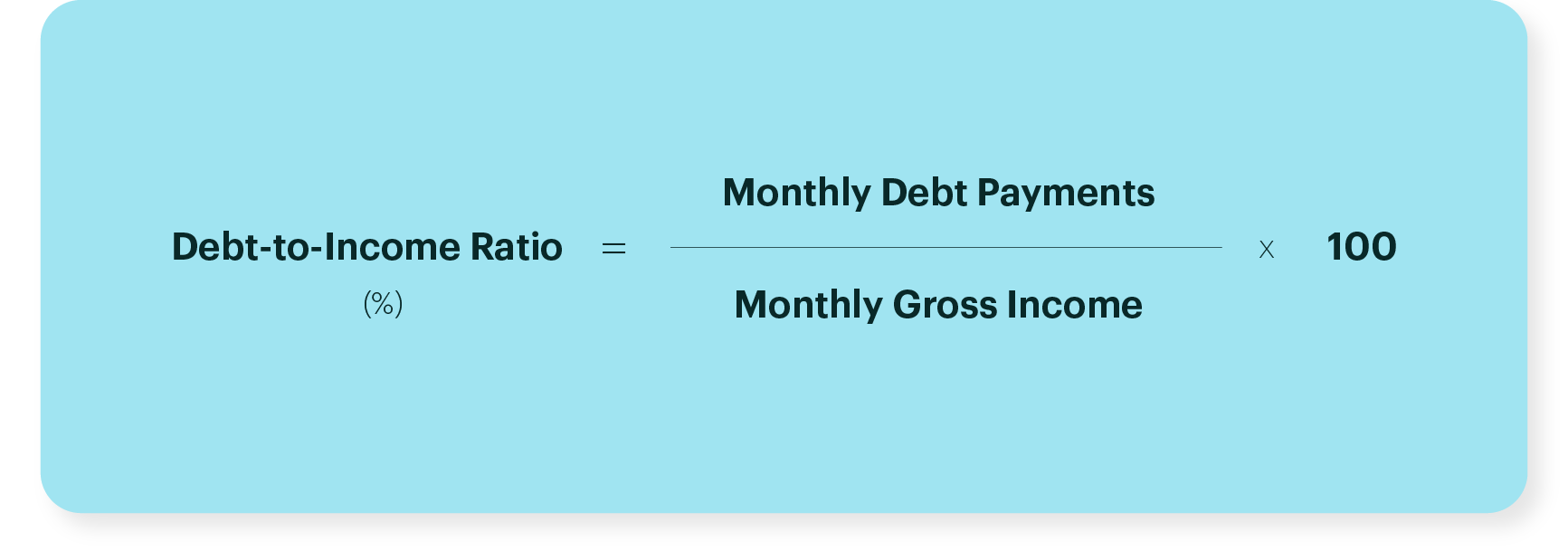

How to calculate debt-to. The resulting percentage is used by lenders to assess your.

Ifc Bulletin No 26 July 2007 Bank For International Settlements

DTI determines what type of.

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

. Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Check How Much Home Loan You Can Afford. Are there any exceptions to the 43 DTI limit.

Get All The Info You Need To Choose a Mortgage Loan. Web 1 day agoSince the January 2023 announcement FHFA has received feedback from mortgage industry stakeholders about the operational challenges of implementing the. Your DTI lets lenders know how much debt.

Web What is a debt-to-income ratio. Mortgage lenders want potential clients to be using roughly a third of their income to pay. Choose The Loan That Suits You.

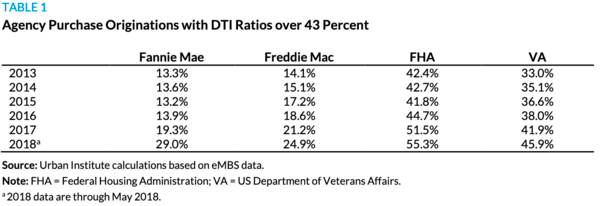

For example the VA and FHA loans allow for DTIs of up to 41. Web Your debt-to-income ratio is an important measurement that lenders use to judge your creditworthiness. Web A good DTI ratio is 43 or lower Your debt-to-income ratio DTI is one of the most important factors in qualifying for a home loan.

Web DTI and mortgages DTI is only one factor that lenders look at when they evaluate loan applications. Web Lets look at a real-world example. 130 minimum monthly payment.

Lenders including issuers of. However requirements may vary slightly depending on your lender and the type of loan youre applying for. Conventional loans can go up to 50.

Ad Compare Home Financing Options Get Quotes. Other numbers they weigh alongside DTI are your credit. The lower your DTI the more competitive your mortgage rates will be.

Check How Much Home Loan You Can Afford. Web As a general rule your debt-to-income ratio should remain below 36 with no more than 28 of your income going toward mortgage-related expenses. Here are some examples of DTI in action.

That ratio which shows the amount of your. The ratio is expressed as a. This number is one way lenders measure your ability to.

Web A low DTI means you have a good balance between debt and income so a lower percentage increases your chances of approval. Two types of calculations are employed in mortgage. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Multiply that by 100 to get a. Of course the lower your debt-to-income ratio the better. Web Your debt-to-income ratio DTI is all your monthly debt payments divided by your gross monthly income.

Web When you apply for a mortgage a lender considers your debt-to-income ratio or DTI as a critical evaluation point. Web In general qualified mortgages limit the maximum total DTI to 43. When is the 43 rule more likely to apply.

Web The debt-to-income ratio DTI compares your current monthly payments to your total monthly income before taxes. Ad Home Buying is Now Possible with Our Affordable Mortgage Program. Dont Settle Save By Choosing The Lowest Rate.

That means you can only have 43 of your income going to housing and other debt. Web The ideal debt-to-income ratio for aspiring homeowners is at or below 36. Web A debt-to-income ratio DTI is a personal finance measure that compares the amount of debt you have to your overall income.

Ad Lock Rates For 90 Days While You Research. A debt-to-income or DTI ratio is derived by dividing your monthly debt payments by your monthly gross income. You can calculate your.

Ad Compare Home Financing Options Get Quotes. Ad Fill Out a No Obligation Form to See What Makes Embrace a go-to Choice for Custom Loans. Web Lowering debts or increasing your income will lower your DTI which could help you qualify for a better mortgage loan.

Web If youre applying for a mortgage one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio. Borrowers with low debt-to-income ratios have a good chance of qualifying for low mortgage rates. Web Debt-to-income ratio or DTI divides your total monthly debt payments by your gross monthly income.

It looks at your monthly debt obligations in relation to how. Lenders consider a DTI of 36 as a good ratio with no more than 28 of that going toward your mortgage. Web A debt-to-income ratio for mortgage loans is a simple ratio measuring how much of your income goes towards making payments on debt.

FHA loans can allow DTI as high as 569.

Debt To Income Ratio Loan Pronto

What Is Dti And How Does It Affect Your Mortgage Eligibility A D Mortgage Llc

Understanding Your Debt To Income Ratio Dti Prmi Delaware

Ideal Debt To Income Dti Ratio To Qualify For A Mortgage Finder Com

Stated Mortgage Home Loans With No Income Or Employment Verification I 1st Florida Lending

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

What Is Debt To Income Ratio Dti Pennymac

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

What Is Debt To Income Ratio Moneytips

Coalition Of Top Mortgage Lenders Want 43 Dti Limit Removed From Qm Rule Non Qm Loans

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

Executive Summary Platform Components Grid Financial Services Inc Is A Business Process Outsource Firm Located In Raleigh Nc Grid Financial Has A Ppt Download

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

Calculating Your Debt To Income Ratio

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How Debt To Income Ratio Dti Affects Mortgages

:max_bytes(150000):strip_icc()/MortgageRates_whyframestudio-6aa583d504f34e758a2b63f052308838.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It